This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

AS Partners., headquartered in Chiyoda-ku, Tokyo, is a diversified service company focused on senior care and real estate development in the Tokyo metropolitan area. Since its establishment in 2004, the company has provided integrated solutions that enhance quality of life for seniors while contributing to sustainable community development. As of April 2024, the company operates with 1,684 employees and is listed on the Tokyo Stock Exchange Standard Market under the ticker 160A.

The company operates two main businesses. Its core Senior Care segment offers assisted living facilities, day services, and short-stay care, operating 47 facilities across the Greater Tokyo Area. These services are delivered through a dominant strategy, with facilities concentrated within the convenience zone of National Route 16. The company has developed a proprietary IoT system called “EGAO link,” which improves operational efficiency and enables personalized, data-driven care. Over 80% of care workers are hired as new graduates, and robust internal training supports a sustainable workforce strategy.

In its Real Estate segment, AS Partners engages in the development of senior housing, rehabilitation of aging properties, and management of income-generating assets. The synergy between its real estate and care businesses enables the design and delivery of highly livable facilities tailored to resident needs. Some properties are self-developed and later sold to investors, contributing directly to segment profitability.

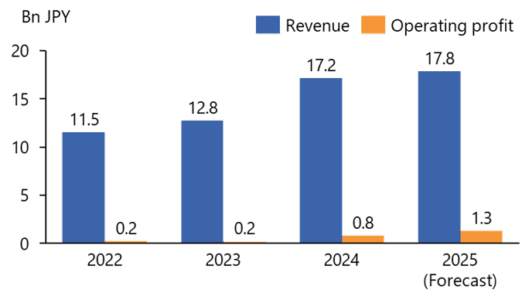

For the fiscal year ending March 2024, AS Partners reported revenue of ¥17.15 billion, a 34.2% increase year-over-year, and operating profit of ¥805 million, marking record highs. The Senior Care segment contributed ¥12.07 billion in revenue (+11.8% YoY), while the Real Estate segment surged to ¥5.21 billion (+146.9% YoY), driven by the launch of the Senior Development business and successful property sales. Net profit rose to ¥563 million (+145.3% YoY).

Looking ahead, the company forecasts revenue of ¥17.84 billion and operating profit of ¥1.28 billion for FY2025. Growth will be supported by higher occupancy in newly opened homes, continued expansion in care facility capacity, and large-scale real estate transactions. Furthermore, AS Partners is exploring new revenue streams through DX consulting services and proprietary app development for the broader senior care industry, leveraging its expertise and strategic alliances with companies like Paramount Bed.

AS Partners Co., Ltd. aims to transform the senior care landscape in Japan by offering scalable, high-quality services and contributing to a more inclusive and sustainable society across generations.

| Company Name | As Partners |

| Headquarters | 2-2, Kanda-Surugadai 2-chome, Chiyoda-ku, Tokyo |

| Website | https://www.as-partners.co.jp |

| Year of Establishment | 2004/11/2 |

| Listing Date | 2024/4/4 |

| Industry | Service industry |

| Business Overview | ・Senior Care Services: Providing nursing homes with care services, day care, and short-stay programs for the elderly. ・Real Estate Business: Developing nursing home facilities, revitalizing aging properties, and leasing apartments and other real estate. |

| Representative (CEO) | Kenji Uemura |

| Number of Employees | 835 (as of 2024/1/31) |

| Stock Exchange | Tokyo Stock Exchange Standard |

| Auditor | FRIQ |

| Lead Underwriter | Nomura Securities |

| Market capitalization (at opening price) | 10,005 million yen |

| PER (at opening price) | 38.56 |

| Major shareholders (Top 3) | •Breathless Corporation (43.49%) •MIRARTH Holdings Corporation (19.33%) •Kenji Uemura (14.66%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance