This article introduces recently IPO-listed companies in Japan while highlighting key challenges, business opportunities, industry trends, and unique business models in the Japanese market.

Rezil., headquartered in Tokyo, Japan, is a climate tech company building a distributed energy platform to address Japan’s decarbonization and energy resilience challenges. Founded in 1994, the company has evolved from a power retail and electrical services provider into a multi-division enterprise focused on distributed energy infrastructure, green energy supply, and energy DX (digital transformation). Its mission is to strengthen the foundation for a carbon-neutral society by enabling efficient energy use and regional self-sufficiency through technology.

Rezil operates three core businesses:

As of June 2024, the company employed 223 staff, including engineers, sales professionals, and energy consultants, and served over 425,000 end users through its platform. It has two main offices in Tokyo and Osaka and wholly owns two subsidiaries: Chuo Electric Power Solution Co., Ltd. and Chuo Electric Power Energy Co., Ltd.

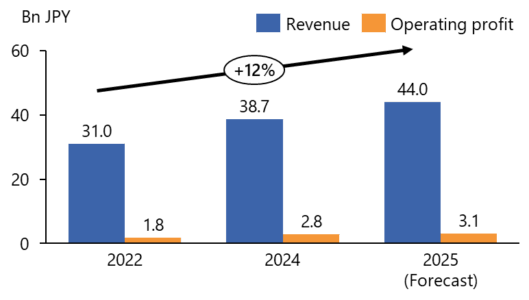

For the fiscal year ended June 2024, Rezil reported consolidated revenue of ¥38.7 billion, operating profit of ¥2.8 billion, and EBITDA of ¥3.8 billion. These figures reflect double-digit growth driven by strong performance across all segments, especially in apartment-based bulk power and municipal green energy supply. For FY2025, the company projects ¥44.0 billion in revenue and an EBITDA of ¥4.3 billion, with continued investment in disaster-resilient infrastructure, platform DX, and regional power grid optimization.

With more than 30 years of client relationships and domain expertise, Rezil aims to lead Japan’s decentralized energy shift by scaling its digital platform and DER integration. Its long-term vision is to become the central orchestrator of low-cost, carbon-free, and resilient electricity for homes, municipalities, and enterprises across Japan.

| Company Name | REZIL |

| Headquarters | 1-8-1 Marunouchi, Chiyoda-ku, Tokyo, Marunouchi Trust Tower N, 14th floor |

| Website | https://rezil.co.jp/ |

| Year of Establishment | 1994/11/21 |

| Listing Date | 2024/4/24 |

| Industry | Electricity & Gas |

| Business Overview | Driving energy sector DX through renewable power supply, distributed generation, and digital solutions for energy providers. |

| Representative (CEO) | Tanji Hozumi |

| Number of Employees | 174 (as of 2024/2/29) |

| Stock Exchange | TSE Growth |

| Auditor | PwC Japan |

| Lead Underwriter | Daiwa Securities |

| Market capitalization (at opening price) | 22,106 million yen |

| PER (at opening price) | 16.3 |

| Major shareholders (Top 3) | •Team Energy GI Corporation (56.78%) •Seiji Nakamura (19.29%) •Kansai Electric Power Company (9.10%) |

This document has been prepared based on information available at the time of the research. While we strive for accuracy, we do not guarantee the completeness or correctness of the information provided. This document is for informational purposes only and does not constitute investment advice or a recommendation. Readers are encouraged to conduct their own verification and due diligence before making any decisions.

Source: Tokyo IPO, Official Website, Yahoo! Finance